If you want to make big money, whether it is in stocks, commodities or even real estate, you need to exploit trends.

Virtually every billionaire investor has had success by hitting homerun trades throughout their careers.

For our purposes here, we are going to focus on the concept of trend following and how it is applied in the commodity futures markets.

Trend following when it comes to trading is simply buying high and selling higher, or selling low and buying back lower.

The idea is to exploit the few large trends in the markets that occur from time to time within the larger context of generating long term, positive absolute returns.

When the markets are not trending, these strategies tend to experience losses.

The concept of trend following is certainly not new to the investment world.

One of the most famous traders of the early 20th century, Jesse Livermore, clearly employed trend following as his primary trading strategy.

You can read his autobiography in the book “Reminiscences of a Stock Operator” written under the pen name Edwin Lefevre. This book is among a select few that are often required reading within trading firms.

Systematic trend following is the strategy most commonly used by the longest running commodity trading advisors (CTAs).

One of the most famous of these traders is John W. Henry, owner of the Boston Red Sox. Henry managed client funds from 1982, until closing his shop at the end of 2012.

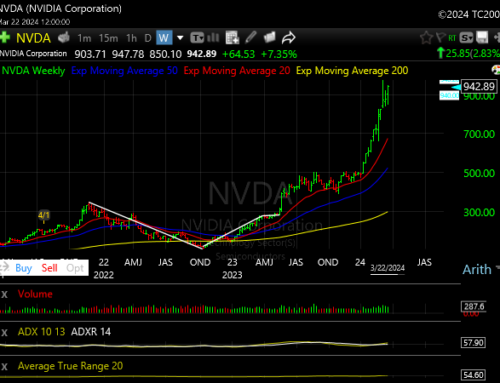

This is a continuation chart of cocoa futures as of March 22, 2024. This is a perfect example of the type of trending move that trend following traders seek to exploit.

On the other hand, this is a recent chart of cotton futures where the market traded within a choppy trading range for most of the year. Trend followers lose money in these market conditions.

Trend followers in the futures markets tend to apply the same strategies across a portfolio of 30, 50, or even over 100 global futures markets.

By trading a diversified portfolio, they will increase their odds of hitting the homerun trades that come along from time to time.

Trend following strategies

Trend following traders employ a variety of strategies in an effort to capture the majority of a trending move.

These include moving averages, channel breakouts and even Bollinger Bands.

However, each of these strategies will result in more losing trades than winning trades.

The trend follower makes money over the long run because they make far more money on their winning trades than they lose on their losing trades.

They do this by cutting losses short with a reasonable stop loss after they enter a position, and letting profits run.

Trend followers do not use price targets to exit positions.

I’ve been following the performance of trend following traders for thirty years.

I’ve watched them make big money during inflationary environments and struggle during deflationary periods.

Over the last few years, they’ve made big money.

This won’t go on forever, but it is clear we are in the midst of an inflationary environment.

I’ll be discussing this concept a bit more in future articles.